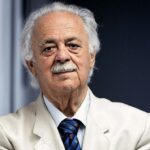

In a recent interview with the Sunday weekly newspaper “To Vima”*, Greece’s representative at the International Monetary Fund Michalis Psalidopoulos notes the progress made in the effort towards a definitive solution to the Greek debt issue.

Michalis Psalidopoulos, who is also Professor of the History of Economic Thought at the Department of Economics, University of Athens and has been president of the Center of Planning and Economic Research (KEPE), underlines that the last proposal on the table relates to the connection of debt repayment with the growth rate of the economy, which has in the past been successfully implemented in other countries. He further points out that the third review will be concluded as planned, that asking for additional measures defies reason, and that besides reforms and fiscal adjustment the IMF has been consistently asking for debt relief, as well as lower primary surpluses for the near future.

On the issue of banks, Psalidopoulos, who recently took part in the meeting between PM Alexis Tsipras with IMF director Christine Lagarde, notes that the consolidation of portfolios is only a matter of time, clarifying that no other measures will be taken:

Alexis Tsipras noted last week in Washington that the IMF needs to remain in the programme. So, is the IMF friend or foe?

Neither one nor the other; the IMF is an international organization that promotes financial stability worldwide, prescribing a treatment formula to a country in crisis asking for its financial support. This treatment is applied with minor variations globally, for reasons of equal treatment of its member states. In Greece’s case, the IMF has asked for reforms and fiscal adjustment, but, as we know, it has also been asking for debt relief, as well and lower primary surpluses in the near future.

Are there prospects of financing by the IMF in the future?

Yes, once the programme approved in principle last July becomes activated. The sum earmarked amounts to around one billion Euros.

The third review has begun. Are you optimistic for a smooth conclusion?

Contacts between the Greek authorities and the IMF, statements and releases, as well as communications from Europe, all lead to the conclusion that the third review will be completed according to schedule.

Is the possibility of calling for new measures excluded?

Nothing could be excluded in reality, but it does not stand to reason to look for additional measures in a review focusing on privatizations and public sector reforms.

Is the situation with Greek banks a matter of concern to you? It appears that many fear if further funding is needed, then new measures will be required.

It’s no secret that the banks have a large percentage of non-performing loans in their portfolios, and already procedures leading to gradual decrease of this exposure have been launched. I’d like to remind you that according to existing data, about a quarter of these non-performing loans relate to strategic bad-payers. It is therefore a matter of time for bank portfolios to be consolidated, without any need arising for additional measures. You could check out related remarks by Ms Danièle Nouy (Chair of the Supervisory Board at the European Central Bank) of October 20th.

Will financial guardianship and austerity come to an end along with the end of the programme?

With the end of the adjustment programme, Greek economic policy regains control of the initiatives and choices it had before entering rescue programmes. Of course, a post-programme supervision scheme will come into effect monitoring the performance of the economy, the continuance of reforms and the achievement of the quantitative targets in primary surpluses that the country has committed to. Ireland, Cyprus and Portugal are in this position. But the financial supervision as we know it today comes to an end and Greece, to the extent that the recovery of its economy will allow, can find the fiscal space it needs on the path towards a new model of development without austerity and further impairment of living standards.

What is your assessment as regards Greek debt? Are we close to a solution? There is also the disparity between the IMF and Europe, especially Berlin.

Let’s not forget that there are already two Eurogroup decisions, of May 2016 and June 2017, which have identified several issues concerning Greek debt and its sustainability. There are many proposals that have unofficially been leaked regarding further debt arrangements which will be announced in future and implemented after the end of the current programme. Thus, we’re on course towards a definitive solution. The disparity to which you refer exists, and the issue at stake is the extent of debt writedown. The IMF requests from Europe the parametric data it needs to enter to its debt sustainability calculation formula that will allow it to conclude that Greek debt is sustainable.

What is the best solution for Greek debt? Debt mutualisation through the introduction of Eurobonds for instance?

Introducing Eurobonds is currently ruled out, as is the nominal writedown of debt. I’d say that no developments on those fronts should be expected. So what’s left? Extension of maturities, debt consolidation, lower than current interest rates, and by and large long term normalization so that there would not be huge amortisation installments at various points in time. The latest proposal under discussion connects debt repayment to the growth rate of the economy that has been successfully implemented in other countries.

Many in the EU do not regard the IMF as credible, and as such, favour the creation of a European monetary fund. How feasible is this?

Everything is feasible in politics. It is true that even the outgoing Finance Minister of Germany Wolfgang Schauble mentioned this in a previous interview as a desired European move. The European Stability Mechanism (ESM), as it is known, is an evolution of the Greek Loan Facility and the European Financial Stability Facility (EFSF). Europe is always on the move in these matters, something that isn’t always immediately noticeable. An issue at stake in order to proceed and implement the decision for a European Monetary Fund would be designating its line of fire, in other words, its capital adequacy. We shall see.

How accurate can the forecasts – we heard Alexis Tsipras refer to them- about the growth rate be in the following period? Is it easy for Greece to return to a state of normality and economic growth?

Forecasts are an advance view of the future. They are based on current developments, indicator variations and conjectures about the future, according to which Greece will return to a state of normality and economic growth. This is in the interest of all Greeks. According to research I conducted on the Greek economy of the 1950s, the opinions and conclusions of American bureaucrats leaving the country in the middle of that decade were that, on the basis of their experience here, the Greek economy will have great difficulty in recovering or may not recover at all. And Greek people proved them wrong: Poverty-stricken Greece became a member of the European Union and the Economic Monetary Union. Greece lost part of her wealth in the last seven years, but is in position, if left alone, to get back on the path to productive recovery and prosperity on the basis of a new productive economic model.

*Μιχάλης Ψαλιδόπουλος: «Προχωρεί η εξεύρεση οριστικής λύσης για το χρέος» (5.11.2017)