Investment activity in Greece is expected to accelerate next year, helping to raise the country’s growth rate to 2.4%, according to the quarterly report released on October 24 by the Foundation for Economic and Industrial Research (IOBE). Next year will see fixed investment in the country increase by 12 to 14% on a yearly basis, IOBE predicted. The Athens-based think tank maintained its economic growth forecast for 2018, based mainly on exports, which are predicted to rise 8% from 2017 by year-end, and the slight increase in household consumption in the second half of the year, by 0.6% on an annual basis, which will keep the growth rate in line with the estimates of the country’s creditors, the report noted.

IOBE’s forecast for 2019 in brief

- Acceleration of private consumption (≈ +1.4%)

- Expansion of public consumption (≈ +1.5%)

- Investment escalation (>+11%) due to activity in privatizations-concessions; continuing recovery of construction activity; larger contribution of the Public Investment Programme

- Milder exports increase (5.0% – 5.5% y/y) due to international trade protectionism measures and loss of Q-E boost in Euro Area demand

- Escalation of import demand (6.0% – 6.5% y/y) due to more investments and higher private consumption

- Unemployment slightly below 18.0% : more employment positions in tourism, construction, public sector & trade.

- Slightly faster price level increase (≈ 1.3%) affected by oil prices, in conjunction with the lower €/$ exchange rate, but also because of higher private consumer demand.

- Acceleration of growth rate in 2019, around 2.4%

The General Director of IOBE, Professor Nikos Vettas noted during the report’s presentation:

- In August, an 8-year cycle of three successive programs of economic support and adjustment was completed. A significant amount of adjustment and rebalancing has been achieved, which cannot be underestimated.

- Qualitative features of the adjustment remain problematic, hence this coming period is crucial as per the medium-term trajectory of the economy. It is problematic that the economy adjusted rather through recession and not through its structural transformation. The recent recorded growth rates, even if positive; they lag the level which would signal convergence with the Euro Area.

- In relation to external balance, exports expansion has to be further strengthened in order to offset the unavoidable future increase of imports. As per competitiveness, there is a risk that it is undermined by labor cost increases, to the extent that these are not aligned with productivity and improvements in the business environment.

- While there is a prospect for a positive scenario for the economy, such a path is neither automatic nor guaranteed. It is crucial when and under which conditions the economy will regain substantial market access, in order to improve domestic financing conditions which remain weak. The economy is currently on a “transit area”, where there is neither the adjustment programs’ “protection”, nor market access.

- The existence of the “cash buffer” cannot lead to complacency. The longer the period of reliance on “extra-ordinary” financing, the higher the chance that ordinary financing will become more difficult. Of equal importance is the issue of total financing for households and businesses.

- From a fiscal perspective, on one hand it is clear that accomplishing a significant primary surplus enhances the credibility of economic policy. On the other hand, the fact that the achieved surplus is not financed by growth, on the contrary it reflects a policy mix which is not in line with robust growth prospects in the medium run, hampers the economy’s external financing.

- On some alarming signals: low public investments, low real estate prices also due to distortionary taxation, and excessive labor tax wedge through social security contributions, in the context of a wider necessary pension system reform.

- The public debate and confrontation is monopolized by a single topic, whether the scheduled pension cuts for existing pensioners may be postponed or cancelled. The real issue should be how to create conditions, so that in the future it is possible to gradually increase all pensions, in line with wage increases and economic growth.

- Whatever policy decisions are made, these should not signal that the economy will shift towards fiscally irresponsible or growth unfriendly directions. If this happens, then any postponement in pension cuts will be short-lived and cuts will be unavoidable soon later, while the postponement will have wider economic impact.

- In relation to financing, it is crucial to improve banks’ operations as quickly as possible. The accelerated return of deposits and the reduction of NPEs are positive developments, but both can be improved if growth momentum were stronger and wider.

- As the country enters an electoral cycle, and previous experience suggests that this negatively affects the economy through uncertainty and pushing back necessary fiscal or other reforms, it is important to recall that the juncture is crucial and that current growth features are fragile.

- The sense of alertness should be even more pronounced, given that the international and European environment may deteriorate in the short run or even face features of a crisis.

Main report points:

The world economic expansion continues at a highrate, amid signs of gradual deceleration in the Euro Area and instability in some emerging markets (Turkey, Argentina). The driving forces of growth are pro-cyclical economic policies in most countries and rapid world trade expansion. However, the rise of trade protectionism (tariffs between the USA and its trading partners, Brexit negotiations), worsening of economic expectations indices and transition towards tighter global monetary stance will decelerate the global growth momentum in the medium run.

Mild acceleartion in real GDP growth in 2019 due to investments

- Growth decelerated in 2018 Q2, to 1.8% y/y. However, during Jan-Jun 2018, real GDP grew by 2.1% y/y. Growth’s main driving force stems from an improvement in the external balance, primarily though export expansion. Investments retracted by 5.0% y/y, largely affected by a significant drop in shipping investments. Household consumption rebounded to positive trend in Q2, while public consumption growth remained negative.

- IOBE forecasts real GDP growth in 2018 around 2.0%. Exports (proj. +8.0% y/y) are expected to be the main driver. Household consumption is expected to contribute positively. Investment growth has been revised downwards (proj. +4.0% y/y), concentrated on extroverted sectors (manufacturing, tourism, transportation) and in construction privatizations, new buildings). Subdued contribution of the Public Investment Program for a second consecutive year. Public consumption is now expected to contract (-1.0% y/y).

- IOBE projects mild acceleration of real GDP growth in 2019, close to 2.4% y/y, driven primarily by investment expansion (proj. 12%-14% y/y) and a rise in private consumption (+1.4% y/y). Stronger domestic demand will boost imports (proj. 6.0%-6.5% y/y), while trade protectionist trends and the phase out of QE will decelerate exports’ expansion (proj. +5.0%- 5.5% y/y).

- The Jan-Aug 2018 budget targets in cash terms were met, due to higher state revenues (by €1.1 billion) and under-execution of the public investment program (by €923 million).

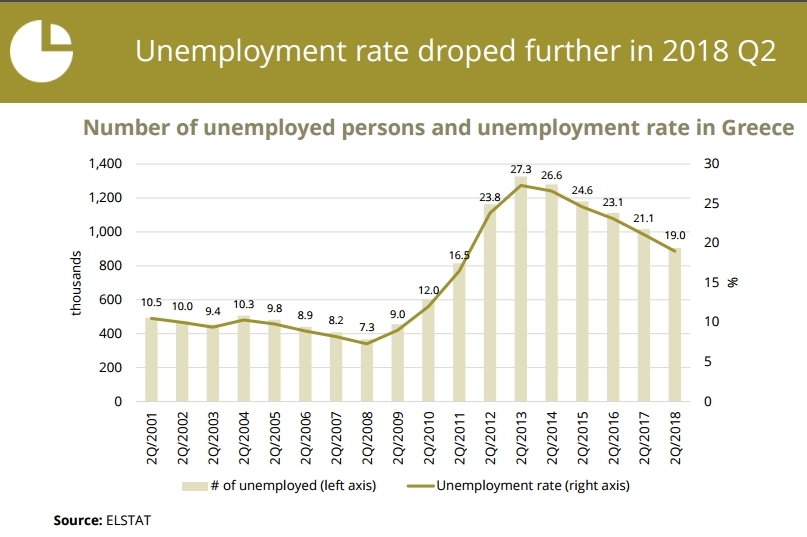

Unemployment rate to drop below 18% in 2019

The unemployment rate dropped further to 19.0% in 2018 Q2, below the threshold of 20% for the first time since 2011. During Jan-Jun 2018 the average unemployment rate was 20.1%, 22.1 ppts below its level a year ago. The reduction in the unemployment rate was driven mainly by an increase in employment by 1.8% y/y or 66.8 thousand (59.6% of the reduction in the number of unemployed) and secondarily by shrinking labor force (by 45.3 thousand). The largest job creation was observed in the health and primary sectors.

IOBE expects further ease of unemployment during 2018, through employment expansion in extrovert sectors (tourism, transportation) plus a higher y/y contribution from construction activity. The improvement in household expectations following the end of the support programs and further ease of capital controls, will be reflected in their consumption, hence positively affecting employment in relevant sectors. Public sector employment will also increase. Consequently, IOBE forecasts the annual unemployment rate close to 19.3% in 2018 and slightly below 18.0% in 2019, when unemployment drop is expected to decelerate.

Inflation rate 1.3% in 2019

Inflation rate was positive during Jan -Sep 2018, reaching 0.5% versus 1.2% in the same period of 2017. Inflationary pressures stem mainly from global oil prices. The impact from indirect taxation was marginally positive. Domestic demand seems to mildly recover, also reflected through the harmonized inflation index excluding energy at constant prices, which has increased for the first time since 2011. IOBE forecasts an annual inflation rate of 0.8% in 2018 and slightly higher and close to 1.3% in 2019.

Banking System: some progress expected in 2019

The banking system confronted strong stock market pressure in mid-2018, despite the positive outcome of the stress tests in May. Key challenge for the banks is the high stock of NPEs and 3 their ambitious reduction targets by 2021, the weak quality of banks’ assets and capital, their weak profitability and hampered ability to issue credit. Nonetheless, some fundamentals exhibited positive trends in mid-2018, such as the accelerated return of private deposits, gradual reduction of NPEs in line with targets, reduction of the ELA and further relaxation of capital controls. Credit contraction to the private sector continues, while some progress is expected in 2019 as long as NPEs continue to shrink including through a more qualitative adjustment, and trust recovery continues to encourage the return of deposits.

->Read the full report here.

->Read also via Greek News Agenda: A Holistic Growth Strategy for Greece; Vicky Pryce: “Greece has achieved a remarkable turnaround”